Find Your

Lost Super

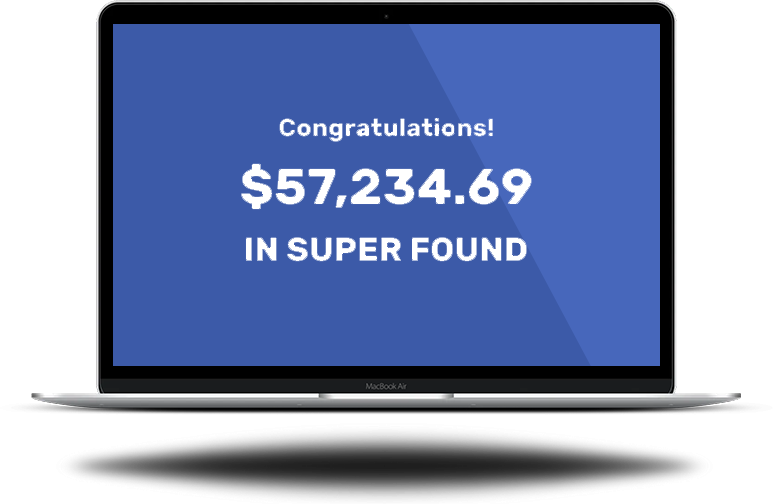

There are billions of dollars in unclaimed super, could some of it be yours?

Complete the form, we'll be in touch with the results.

*100% FREE and No Obligation Guaranteed.

- 256bit encryption

You May Have Lost Super if:

You’ve changed jobs

When you change jobs, quite often your new employer will either select their own default fund or you may simply have forgotten to specify your existing one.

Have been married or changed name

If you’ve been married or changed your name you may forget to tell your superfund about it.

Changed address

When you change jobs, quite often your new employer will either select their own default fund or you may simply have forgotten to specify your existing one.

Australians have $16 billion in lost super held by the ATO. 1

How Lost Super Finder Works?

1. Supply a few details

2. We’ll start the free search

3. Give you the Results

4. Review, and Consolidate.

Consolidating Your Super is easy, Ignoring it Could be Costly.

Why Consolidate your super?

Pay less in fees

Having your super in one account could mean fewer fees.

Less paperwork

One place to keep your details up-to-date.

Keep track of your super

One super account is easier to manage.

Avoid extra insurance cost

Only one set of premiums if you have insurance.

We're here to help

© Lost Super Finder 2023

Quick Links

Factual Information Only Disclaimer

This website contains factual information only and does not consider your personal circumstances, needs, objectives or financial situation. This factual information is not intended to imply any recommendation or opinion about a financial product. This information does not constitute financial advice or taxation advice, and the general nature of the content might not be applicable to you or your situation. Before acting on any information, you should seek professional advice and verify our interpretation/s before relying on the content or calculators within this website, while also considering its appropriateness in relation to your personal situation.